Most doctors imagine insurance failing in dramatic moments.

A claim rejected outright.

A phone call that goes unanswered.

A sudden refusal when help is expected.

That’s not how it usually happens.

Insurance rarely fails loudly.

It fails quietly – on paper.

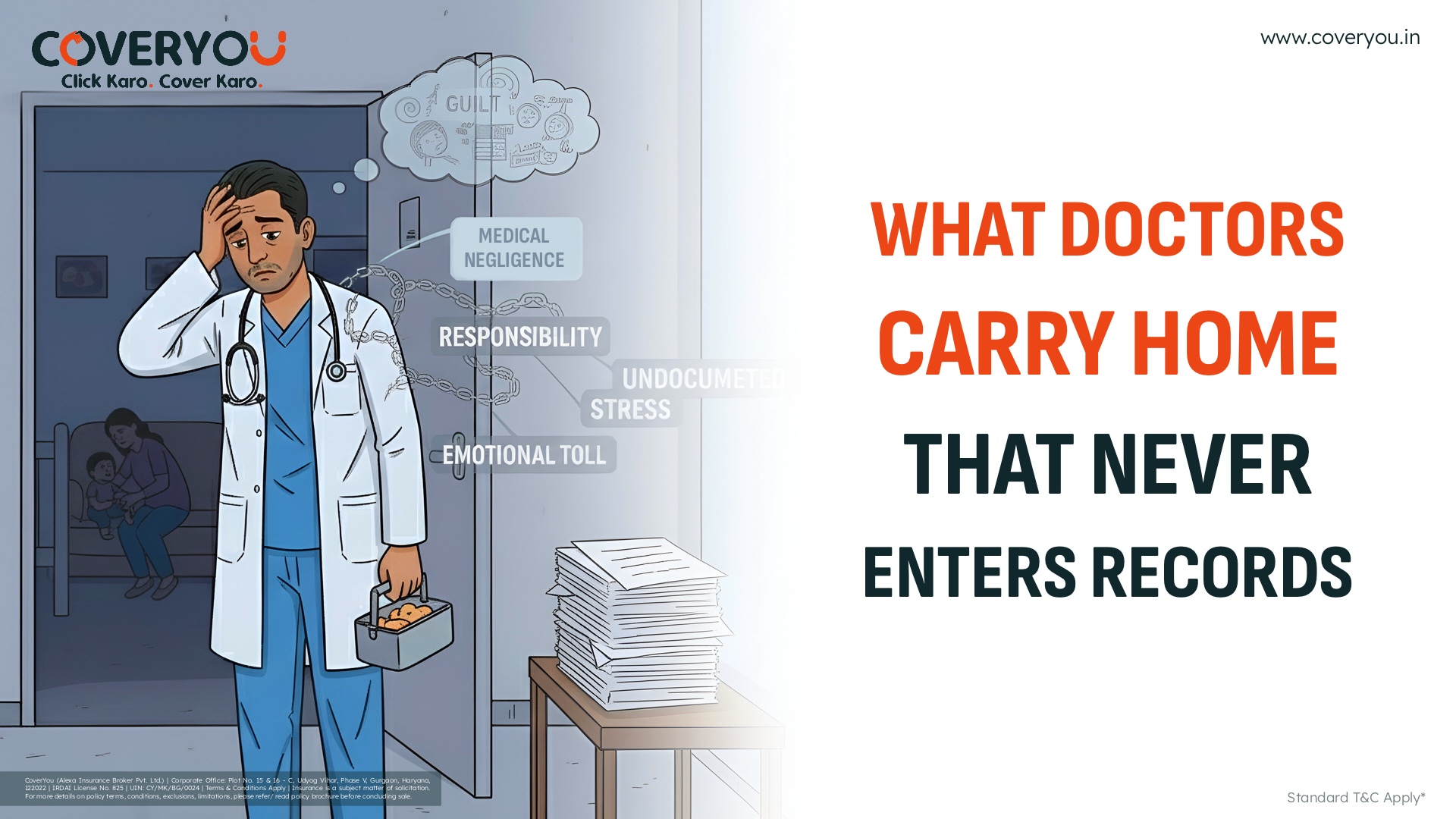

Long before a claim is filed, the outcome is often already decided. Not by intent or negligence, but by small details that felt insignificant at the time they were signed, skipped, or misunderstood.

A clause not read carefully.

A sub-limit assumed to be irrelevant.

A definition interpreted differently by two sides.

None of these create immediate alarms.

Policies don’t warn you when they stop being useful. They don’t notify you when protection narrows. They simply sit there, unchanged, while expectations grow around them.

When something goes wrong, doctors often focus on the incident itself. What happened. Why it happened. Whether it could have been prevented.

The insurance outcome, however, depends on a different trail altogether.

What was declared.

How it was documented.

Whether the event fits the policy’s language – not its intention.

This is where frustration begins.

From the doctor’s perspective, the policy feels present. Premiums were paid. The coverage was active. The incident was genuine.

From the insurer’s perspective, the policy is a document – interpreted line by line, definition by definition. Claims are not evaluated on emotion or effort. They are evaluated on alignment.

This disconnect is where most disappointment comes from.

Not because insurance is designed to abandon doctors, but because it is designed to operate on precision. And precision, when misunderstood, feels like indifference.

Many claim disputes are not about rejection. They are about partial coverage. Limits applied where none were expected. Conditions invoked that were never discussed clearly.

The policy doesn’t collapse.

It narrows.

Quietly.

By the time this becomes visible, the paperwork has already done its work.

This is why experienced doctors don’t ask whether insurance exists. They ask how it behaves under stress.

Not all failures are dramatic.

The most consequential ones are procedural.

Insurance doesn’t fail at the moment of crisis.

It fails earlier – in the margins, the wording, and the assumptions that were never questioned.

End.