Introduction

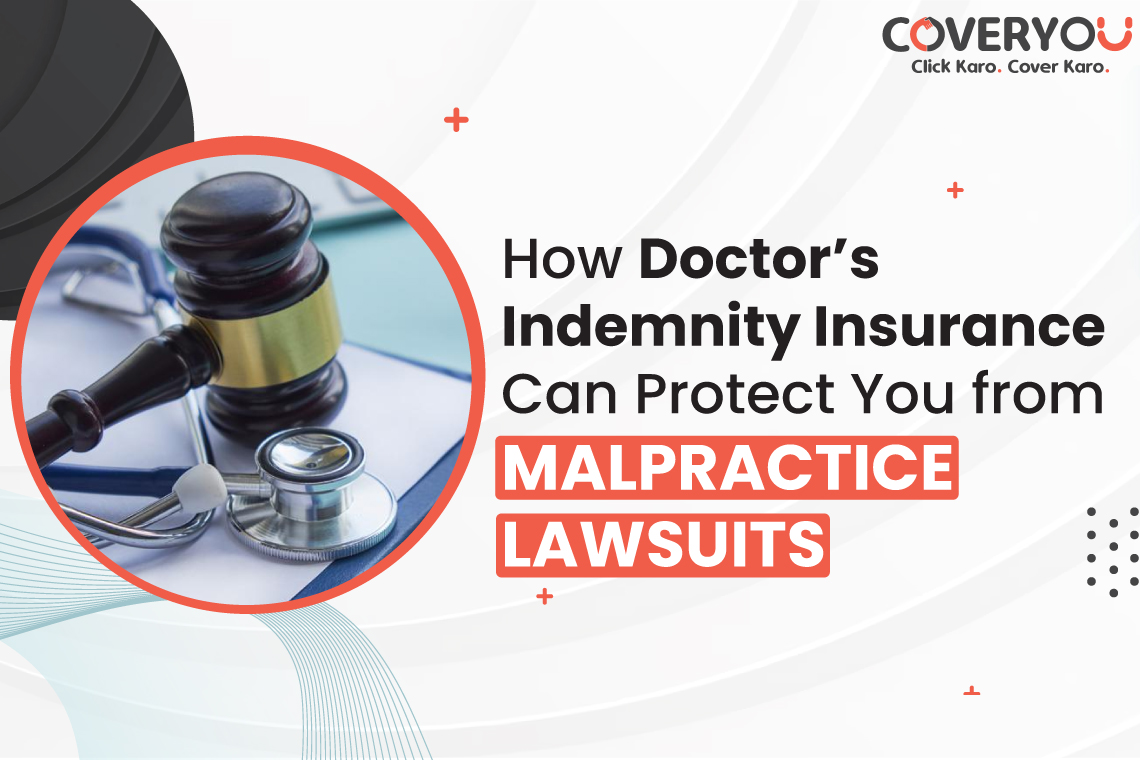

There are two kinds of doctors’ indemnity insurance, both of which provide financial assistance to physicians in the event of a malpractice lawsuit. Many times, patients and their families file a complaint against the physicians who were treating them, and the patient’s health is jeopardized as a result of negligence.

Individual Doctor’s Indemnity Insurance is offered to a single doctor or health professional. It covers the liabilities of the doctor, and its coverage is personalized according to the needs of the individual. The premium here is calculated based on the speciality of the doctor and their claims history.

A Group Doctors Indemnity Insurance coverage is provided to a group of doctors who work for the same organisation. It is usually supplied by their employers. Individual insurance policies provide less coverage than group policies. It cannot, however, be personalised because it is provided by the employer and will have terms and conditions tailored to the requirements of the employer. He can choose individual doctors’ indemnity insurance in addition to group doctors’ indemnity insurance for more personalised insurance coverage.

Table of Contents

- What is individual doctors’ indemnity insurance?

- What is group doctors’ indemnity insurance?

- Difference between individual and group doctors’ indemnity insurance

- Frequently Asked Questions

What is Individual Doctor’s Indemnity Insurance?

Individual Doctors’ Indemnity Insurance is an insurance policy that offers financial protection to an individual doctor or medical practitioner. This type of insurance is important for them as they can face many legal and financial consequences if they get sued for medical malpractice.

It covers the liabilities of the doctor and its coverage is personalized according to the needs of the individual. The premium here is calculated based on the speciality of the doctor and their claims history. It is modified to provide coverage and benefits such as legal support, expert witness fees, etc.

These policies are often purchased by doctors who are self-employed or those who do not have insurance coverage through any organisation.

What is Group doctors’ indemnity insurance?

Group Doctors’ Indemnity Insurance is the insurance policy which offers coverage to a group of doctors against the claims made by patients or their families in case of negligence. It is designed to protect doctors and their practices from financial losses in the event of lawsuits or other legal actions.

Group doctors’ indemnity insurance covers legal fees, damages and settlements associated with medical male practice claims.

These are typically bought on behalf of doctors and staff members by healthcare organisations. Doctors can often acquire Group Doctors’ Indemnity Insurance at a lower cost than if they purchased individual policies.

The doctor and medical practices need to review the terms and conditions of the coverage of the group doctors’ indemnity insurance policies carefully to ensure that they are protected against potential liability claims.

Difference between Individual and Group Doctor’s Indemnity Insurance

The following are the key differences between individual and group doctors’ indemnity insurance:

- Coverage: Individual Doctors’ Indemnity Insurance is purchased by an individual doctor to protect himself or herself against legal claims related to medical practices. This type of policy is personalised for the individual doctor and is not shared with any other doctor or practice. The coverage and premiums for an individual policy are based on the individual doctor’s risk profile and claims history. Whereas group policy offers wider coverage to the doctor as it is based on the risk profile of the group.

- The risk involved and claims: The policies are purchased by the organization on behalf of all the doctors working there, and the coverage and premiums are based on the collective risk profile of the group. While compared to individual policies, a group policy can provide better coverage and benefits. Insurance coverage can be quickly processed, managed, and renewed in a group doctors’ indemnity insurance policy.

- Portability: The portability of the insurance policy means that the coverage stays with the doctor even if they leave the practice in the case of the individual doctor but in the case of group doctors’ indemnity insurance, it is tied to the organisation and may not provide coverage if the doctor leaves and start their practice or join a new organisation.

Frequently Asked Questions

Q1. What is the difference between individual and group Doctor’s Indemnity Insurance?

Ans. The major key points on the differences between individual and group doctors’ indemnity insurance are mentioned below:

- Individual indemnity insurance is transferable whereas group doctors’ indemnity insurance is not.

- Individual indemnity insurance gives coverage based on the doctor’s speciality, and claim history whereas, in group doctors’ indemnity insurance, premiums are based on the collective risk profile of the group.

- Individual indemnity insurance is portable whereas it is not the case in group doctors’ indemnity insurance. If a doctor stops working in the organisation, he cannot make an insurance claim there.

Q2. What are the benefits of choosing individual doctors’ indemnity insurance?

Ans. The following are the benefits of choosing individual doctors’ indemnity insurance:

- Personalized coverage

- Protection of personal assets

- Portability

Q3. How does group doctors’ indemnity insurance differ from individual indemnity insurance?

Ans. Group Doctor’s Indemnity Insurance differs from individual indemnity insurance in the following ways:

- Group doctors’ indemnity insurance offers coverage to a group of doctors or healthcare professionals under a single policy, whereas individual doctors’ indemnity insurance provides coverage to only a single doctor or healthcare practitioner.

- Group doctors’ indemnity insurance offers more cost-effective coverage than individual indemnity insurance as the risk gets distributed across the group.

- However, individual indemnity insurance offers more customised coverage and can be modified to meet the doctor’s specific needs.

Q4. Can you choose both individual and group doctors’ indemnity insurance coverage?

Ans. Yes, you are right. Group Doctor’s Indemnity Insurance is a type of insurance policy that is typically bought on behalf of physicians and staff members by healthcare organisations. Healthcare organisations can often negotiate reduced insurance premiums by buying insurance coverage in bulk for a group of individuals.

Group doctors’ indemnity insurance protects medical professionals from claims made by patients or their families alleging mistakes, omissions, or negligence while performing their professional duties. This coverage can help shield doctors and other medical professionals from the financial ramifications of lawsuits, such as legal costs, settlements, and judgments.

Individual doctors can also obtain group doctors’ indemnity insurance through a professional organisation or a purchasing group. In this situation, they can also benefit from lower premiums and the convenience of group insurance coverage.