Surgery in India represents a different reality, which is a far cry from the neat, organized world of medicine in the West. It’s always a juggling act: balancing advanced technology with innovative adaptation and coping with the sharp juxtapositions between the extravagance of private medicine and the anarchy of the public services. According to government statistics, India spends a mere 1.2% of its GDP on public healthcare, while European nations spend nearly 9%. This leaves surgeons to operate in an arduous landscape with gaps in infrastructure, finance, and patient accessibility.

Two Systems, One Surgeon

The healthcare system in India is a story of two worlds: on one hand, the drab, poorly funded public hospitals, and on the other, the gleaming, profit-oriented private hospitals. Surgeons operate caught between the two. Ironically, nearly 75% of the patients approach the polished, profit-oriented hospitals despite the exorbitant charges. Why do they do it? Public centers such as AIIMS Delhi can keep a patient waiting for six months for a basic surgery owing to their limited resources. A patient’s survival at times depends not on the gravity of her/his illness, but on the proximity of the patient to Delhi or her/his pocket.

Not What’s Ideal, But What’s Possible

In India, the decision usually depends on the circumstances rather than strict protocol. Take the case of an extrahepatic portal venous obstruction, unlikely to be seen in the West but not rare at all here. Diagnosis could be a palpation of an enlarged spleen, an ultrasound, or a simple surgery. The opposite approach from the West usually includes costly imaging and pharmaceuticals. The surgeons here are adaptable, embracing innovative and affordable solutions to suit each patient’s situation.

A Patient’s Value in Triage

Surgical residents, when they encounter a large patient load, usually end up performing the task of triage officers. A farmer from Bihar with a life-threatening illness, for example, would be given priority over a middle-class Delhi resident who has a small hernia. The decision to prioritize a patient depends on the severity of the ailment, the distance a patient may have traveled, and their economic status. This system, though not ideal, saves lives.

The Profit Problem Within Private Healthcare

Private hospitals might have “world-class” equipment, but they are profit-oriented institutions in the modern world as well. It has been reported that nearly 80% of the hospitals in India are commercially oriented, which creates concerns for the patient. Are the procedures and tests really necessary, or are they done to maximize the hospital’s coffers? Surgeons are caught in a dilemma where they are faced with the challenge of making accurate diagnoses, along with considering the expenses, while always being aware of the lurking threat of a lawsuit.

What Must Be Changed: Universal Health Care Now

Presently, India spends only 4.2% of its GDP on healthcare, a mere 1.2% of which comes from the government. To close the gap between the public and the private healthcare sectors, a considerable boost in healthcare expenses must be achieved. This includes increasing the establishment of public hospitals, educating surgeons to tackle India’s special healthcare problems, and increasing the number of non-profit medical colleges. No patient should ever be denied life-saving treatment and education based on profit.

Why Surgeons Remain and Prosper

Amid the turmoil, surgeons opt to remain because their work counts. Patients are incredibly grateful, and every patient encourages the surgeon to innovate context-appropriate, creative solutions. It’s not about the right skills; it’s about the service. The reward in reality? Revivifying life with minimal resources and unflinching resolve.

The Scale of the Challenge

India conducts about 30 million surgeries every year, 85% of them in small and mid-sized hospitals, reports The Financial Express. But the estimated requirement is much greater. According to the reports, the nation needs close to 50 million surgeries annually, of which a large number, roughly one-third, must be done on persons between the ages of 30 and 49. By contrast, rich nations conduct approximately 23,000 surgeries per 100,000 persons, and India’s surgical capacity continues to fall short of that standard. These statistics tell a definitive story: as much as Indian surgeons keep getting into the act, demand greatly exceeds the system’s present capacity.

A Practice of Purpose

Surgery for surgeons in India isn’t about emulating the West; it’s about creating an authentically Indian method. From grassroots innovation to government reform, these surgeons take the lead in reinventing healthcare for 1.4 billion. In their hands, they hold not only a scalpel but also the potential to redefine the face of medicine in India.

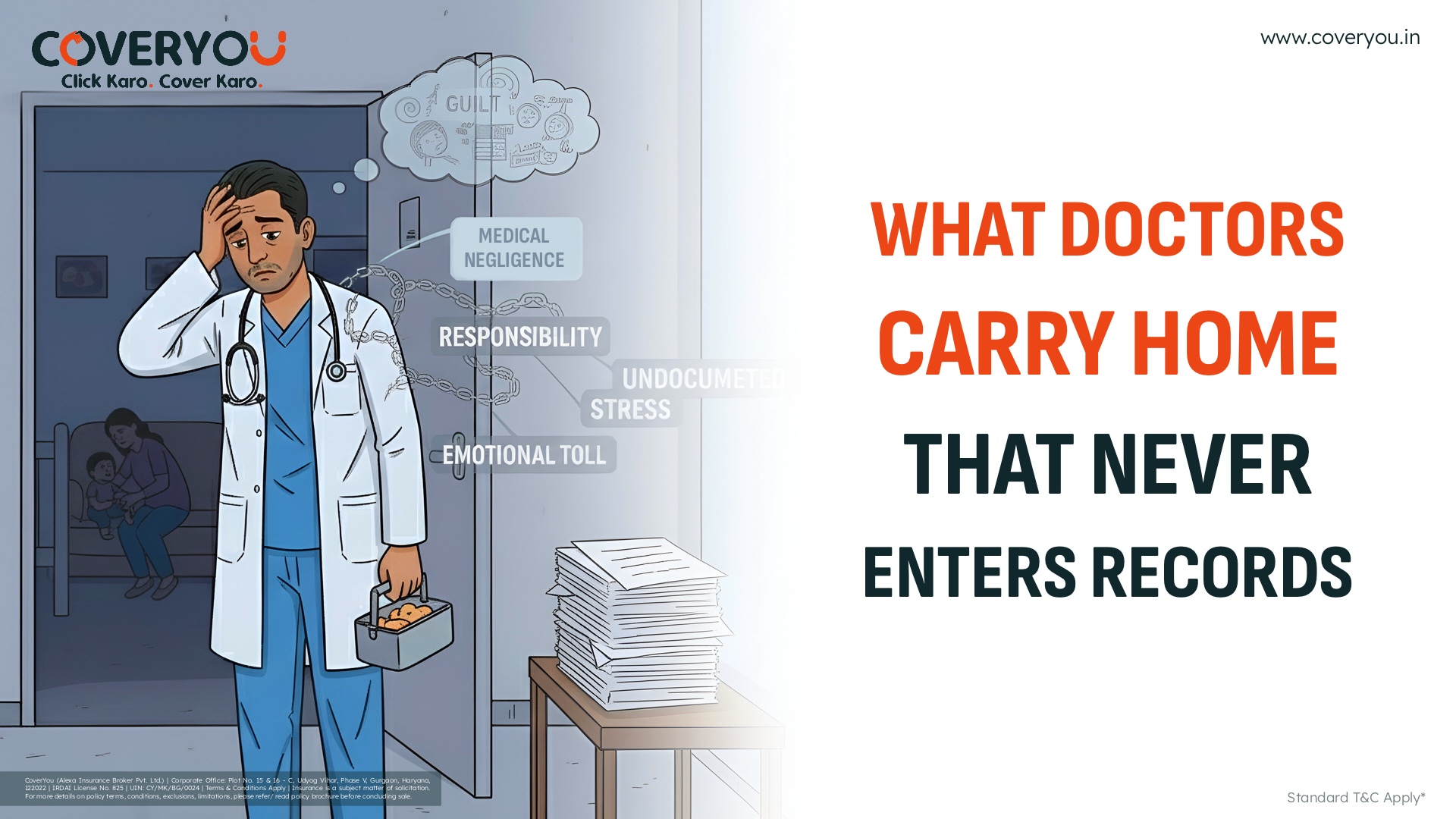

The Cost of Maintaining Two Systems

Trapped between two rival systems, doctors in India fight not only for their patients but often for themselves as well. The suffocating patient load, prolonged hours, and emotional stress tend to result in burnout and, all too often, medical negligence. India sees over 5.2 million claims of negligence each year.

A recent study conducted and published in the Journal of Orthopaedic Case Reports highlighted a 400% increase in medico-legal cases. Having little systemic support and increased public criticism, most healthcare practitioners remain susceptible. Prolonged legal procedures not only tarnish the reputation but also deplete personal funds, further exacerbating the psychological trauma.

A Glimpse of Hope: Professional Indemnity

This is where professional indemnity insurance becomes a requirement, not a choice. It serves as a legal and fiscal umbrella, safeguarding doctors, nurses, and hospitals from claims of negligence. Our in-depth study showed that almost 90% of specialist practitioners with 10+ years of experience had indemnity in place compared to 24% with 5–10 years and 22% with less than 5. The difference is shocking.

Identifying these issues, CoverYou, India’s No. 1 professional indemnity insurance broker, has intervened with a custom-made indemnity policy. Backed by over 95+ associations of doctors from all over India, its policies are customized to reflect the day-to-day situations faced by doctors. These benefits are a highlight of

- All Sources of Medical

- Allocation of a Medico-Legal lawyer within 2 hours

- Out-of-court settlement opportunities

- 18+ benefits specific to healthcare professionals

With India’s surgeons and doctors constantly coming up with innovative solutions despite challenges, they need protection on a par with their bravery. With the right protection, they can save lives while we protect theirs.

Source: