With the rise of healthcare inflation and health issues, medical expenses are also rising faster than ever. It is thus essential for everyone to have health insurance, which will help you save emergency funds and lifetime savings in the event of a medical emergency affecting you or your loved ones. Furthermore, this insurance will assist people in dealing with a rising medical crisis.

To be safe and secure, professionals say that health insurance plans should be included in one’s financial plan and available when they are young and responsible. Moreover, health insurance plans have other benefits, including reduced premium rates, increased insurance coverage, no medical examinations, and so on.

If you’re searching for the best health insurance plan, follow this blog, as it discusses different types of health insurance policies that may suit your healthcare requirements.

Different Types of Health Insurance in India

The upsurge in health-related issues has led to a significant increase in treatment expenditures. This has resulted in the demand for health insurance policies. Based on customer’s needs, there are several types of Health plans available in the market that can help you save money.

Family Health Insurance

If you’re looking for a health insurance policy that would provide for your entire family, then family health insurance is a good deal. As the name suggests, it includes all your family members, including spouses, children, and old people. It will require only one member of the family to pay the premium. If you have two family members receiving treatment simultaneously, you can claim insurance for each of them until the maximum is met.

Mediclaim

There is no pre-notification when it comes to illness and accidents. The same is true when a person has to bear expenses for any of these things. Thus everyone needs to get a health insurance policy. It provides reimbursement for hospitalisation expenses in the event of a sickness or accident. It covers inpatient expenditures like nursing charges, doctor fees, and anesthesia.

Senior Citizen Health Insurance

This type of insurance in India covers people aged 65 or above. So, if you want to buy insurance for parents and grandparents, this will be the top health insurance plan. This policy will cover the expense of hospitalisation and medications due to health conditions or accidents. Senior Citizen Plans also cover post-treatment expenditures.

Critical Illness Insurance

Critical illness insurance protects individuals by offering a reasonable amount of money for life-threatening diseases. The specified health issues are covered when one is impacted by any of the pre-selected diseases during policy purchase. Under this type of insurance policy, hospitalisation is not necessary. Only after being diagnosed with the sickness, you can benefit from critical illness insurance. Under Critical Illness Plan, diseases such as cancer, stroke, paralysis, kidney failure, major organ transplant, and many other severe health issues are covered.

Personal Accident Insurance

Since the road accident rate in India is surveyed to be one of the highest in the world, certain insurance plans have been curated to safeguard residents from the hospital expenses that may occur post-accident. As a result, individuals die or become crippled, and facing the costs of therapy can be quite traumatic. Getting personal accident insurance coverage is a good idea. This insurance policy offers a lump sum payment to the victim or his/her family as compensation.

Individual Health Insurance

An Individual Health Insurance is meant for a single person. It is mostly purchased by a single person. Individuals who enroll in this plan are paid for medical and illness-related expenditures. This sort of medical insurance offers coverage for all surgery, hospitalisation, and pre and post-medication expenses till the covered maximum is met. Based on the buyer’s age and medical history, the premium for the plan is determined.

Conclusion

The rising medical expenses have increased the demand for health insurance in India. To cater to the different needs of people, various types of plans have been curated for everyone. Since many people complain about paying exorbitant premiums and getting fewer benefits in return, you must check what the specific insurance plan is offering and then sign its terms and conditions.

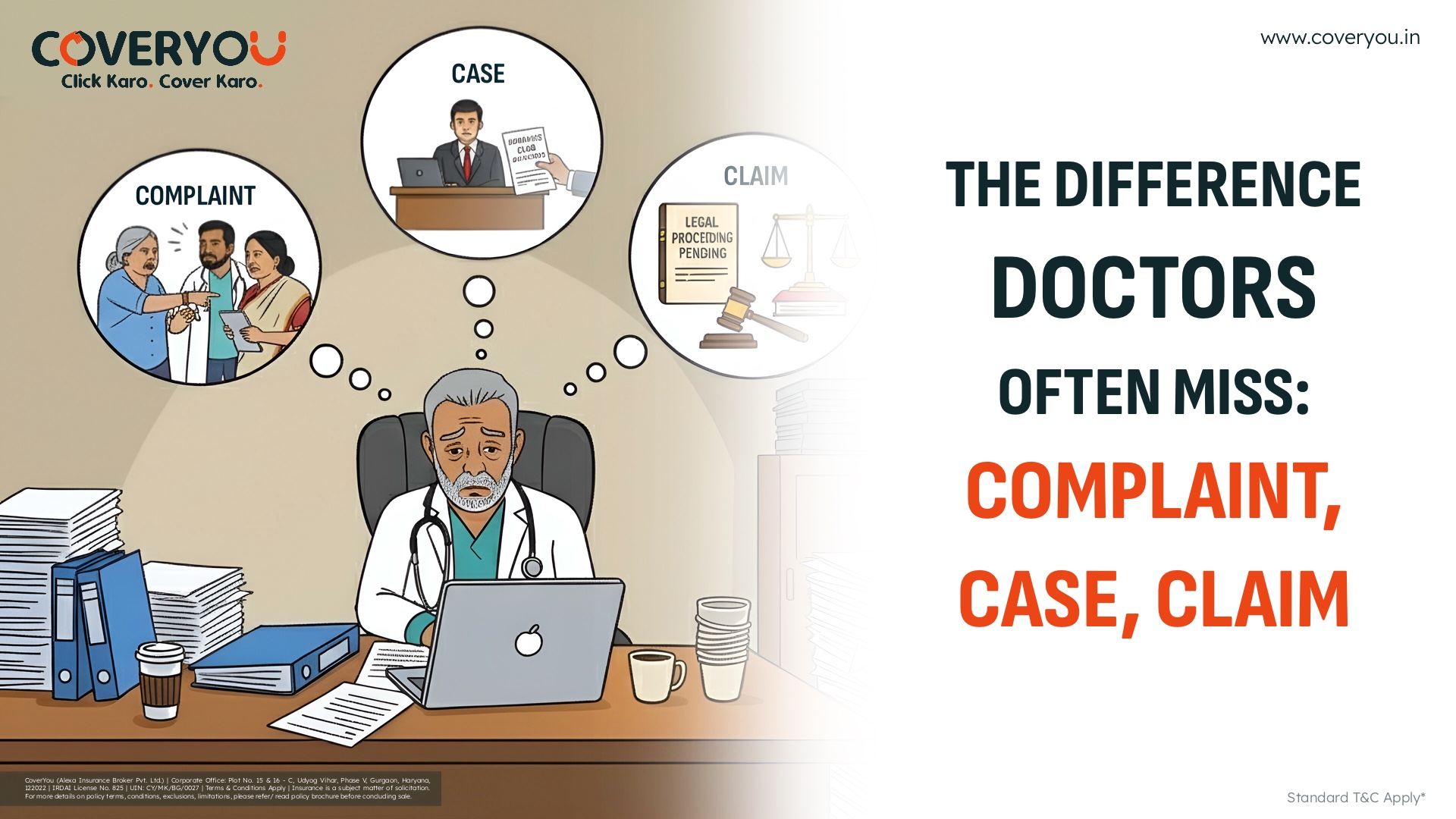

If you’re looking for a company that offers the best plans, then CoverYou is here to rescue you. Every individual has the right to claim coverage for health-related problems, even the doctors. Thus CoverYou has policies for doctors as well. Check out the other health plan features that CoverYou has to offer.

- It covers all daycare treatments.

- With CoverYou, you can cover expenses for pre-existing diseases.

- We provide coverage for the entire family under one policy.

- You can get assistance with air, domestic, and road ambulances for prompt services.

With an IRDAI registration, CoverYou has gained the reputation to be the most reliable insurance broker in India providing the best health insurance plans for all.